Typus Finance? - A Comprehensive Overview of the DeFi Protocol's Solutions for Liquidity Issues on-chain.

Typus Finance is a decentralized finance (DeFi) platform built on top of the Sui Network, a high-performance Layer 1 blockchain. The platform aims to solve the challenges facing the DeFi ecosystem, including high gas costs, low processing speed, and insufficient decentralization and transparency

The decentralized finance (DeFi) market has experienced rapid growth in recent years, with an increasing number of users and investors embracing the technology. However, the DeFi space still faces several challenges, including issues of liquidity, accessibility, and risk management. As a result, several projects have emerged to address these challenges, including Typus Finance. Typus Finance is a DeFi protocol that seeks to address liquidity challenges on-chain, particularly for long-tail assets. The protocol aims to provide users with access to a comprehensive suite of DeFi products, including swap, lending, and derivatives protocols, to enable them to obtain superior risk-to-reward returns all in one click. By leveraging a range of innovative solutions, such as the Modified Dutch Auction mechanism, Auto Rebalancing Tool, Sharpe Optimizer, and Collateral Vaults, Typus aims to revolutionize the DeFi space and enhance market participation for both retail and institutional investors.

What is Typus Finance?

Typus Finance is a decentralized finance (DeFi) platform built on top of the Sui Network, a high-performance Layer 1 blockchain. The platform aims to solve the challenges facing the DeFi ecosystem, including high gas costs, low processing speed, and insufficient decentralization and transparency within ETH-forked chains. By leveraging the advantages of the Sui Network, Typus Finance aims to achieve centralized exchange-level trading speed and user experience.

Products:

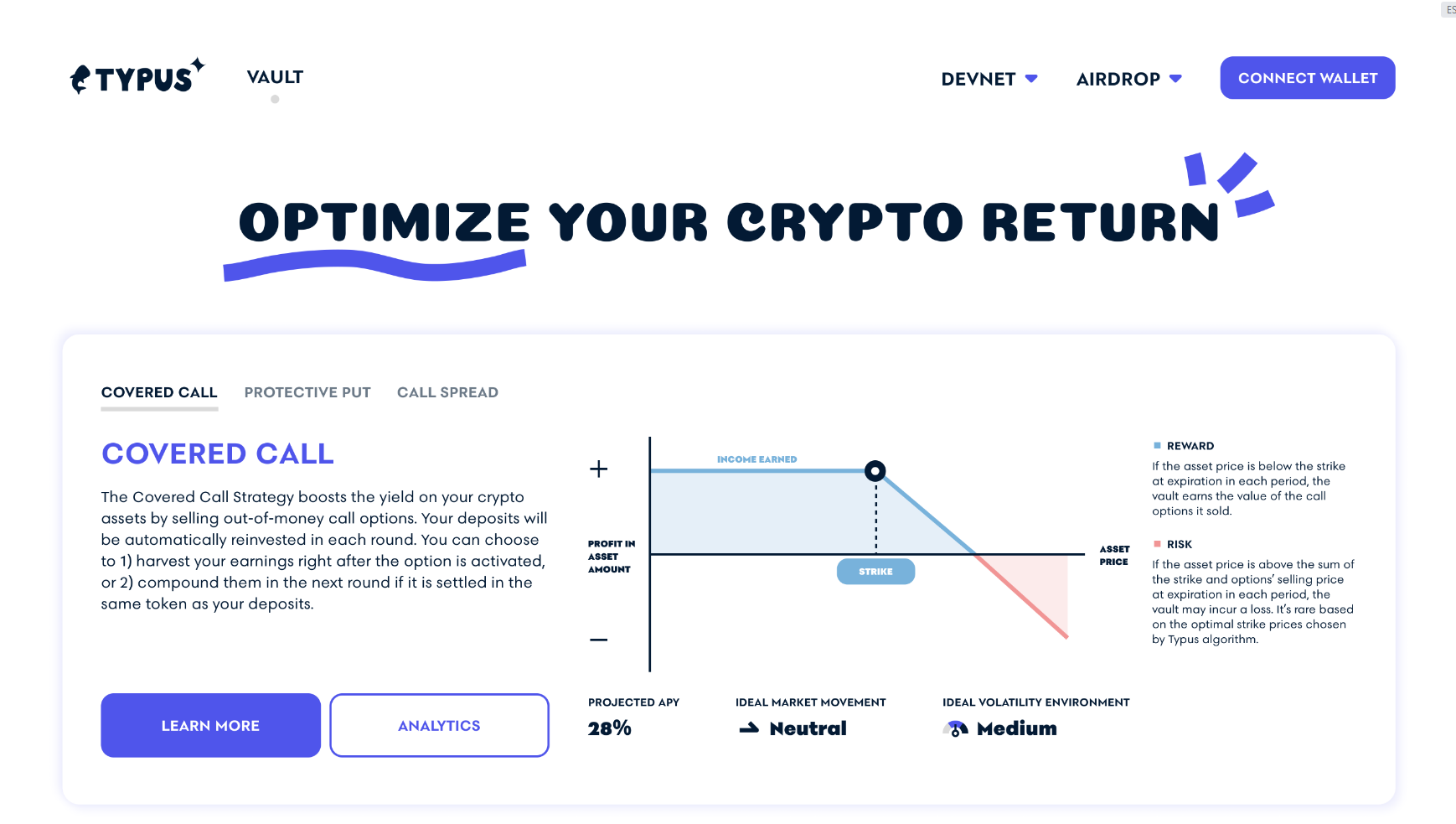

DeFi Options Vaults:

Firstly, Typus Vanilla Options are European-Style Options that can only be exercised on the option's expiration date. Call options are settled in tokens, while put options are generally settled in stablecoins. These options are fully collateralized due to the risks involved in leveraged options with long-tail assets.

- Covered Call is a strategy where vault depositors sell call options and deposit the corresponding underlying asset as collateral. Vault Bidders, on the other hand, buy call options. If the market price of the underlying asset is higher than the Strike Price on the expiration date, the call buyer (vault bidder) will exercise the call option, and the call seller (vault depositor) needs to sell the underlying assets to the call buyer. This strategy can help investors increase their returns in a neutral or slightly bull market movement.

- In Put Selling, vault depositors sell put options and deposit sufficient cash reserves as collateral. Vault Bidders buy put options. If the market price of the underlying asset is lower than the Strike Price on the expiration date, the put buyer will exercise the put option and get the cash reserves from the depositor's collateral. This strategy can help investors increase their returns in a neutral or slightly bear market movement.

- Typus Option Strategies combine call and put options with different strike prices and expiration dates to create a variety of non-linear returns. Vaulters offer diverse strategy vaults and guide users on market conditions that are suitable for each vault to fulfill their individual needs.

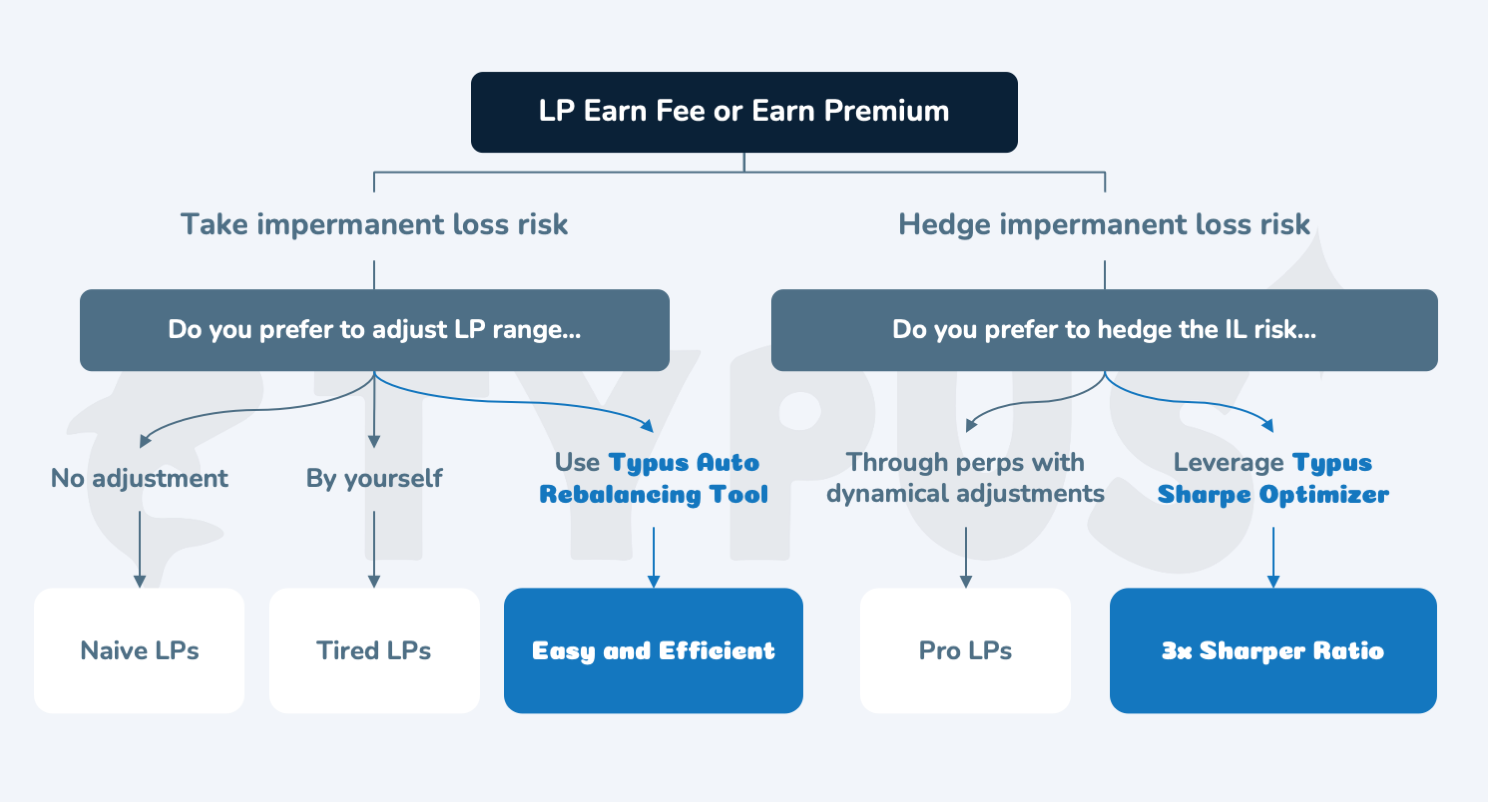

AMM LP Tools:

Typus AMM LP Vaults can facilitate liquidity providers (LPs) to earn fees or premiums in a more efficient and easy way, and potentially achieve better risk-reward ratios.

- Typus Auto Rebalancing Tool simplifies the process of setting LP intervals for AMM pools, which can be challenging for retail investors. To ensure optimal liquidity provision efficiency, LPs need to dynamically adjust the center position and width of the LP interval based on market conditions. Typus is developing a tool that will automatically set the LP range for each asset using market information, including implied volatility traded in the options market, and other dynamic adjustment conditions. This systematic and programmatic approach is expected to be more profitable and reasonable.

- Typus Sharpe Optimizer is an instrument designed to hedge against impermanent loss risk with just one click for liquidity providers in any AMM model. By clicking a button, users can delegate the hedging process to Typus when providing liquidity to an AMM pool. Specific details of the operation will be announced at a later time.

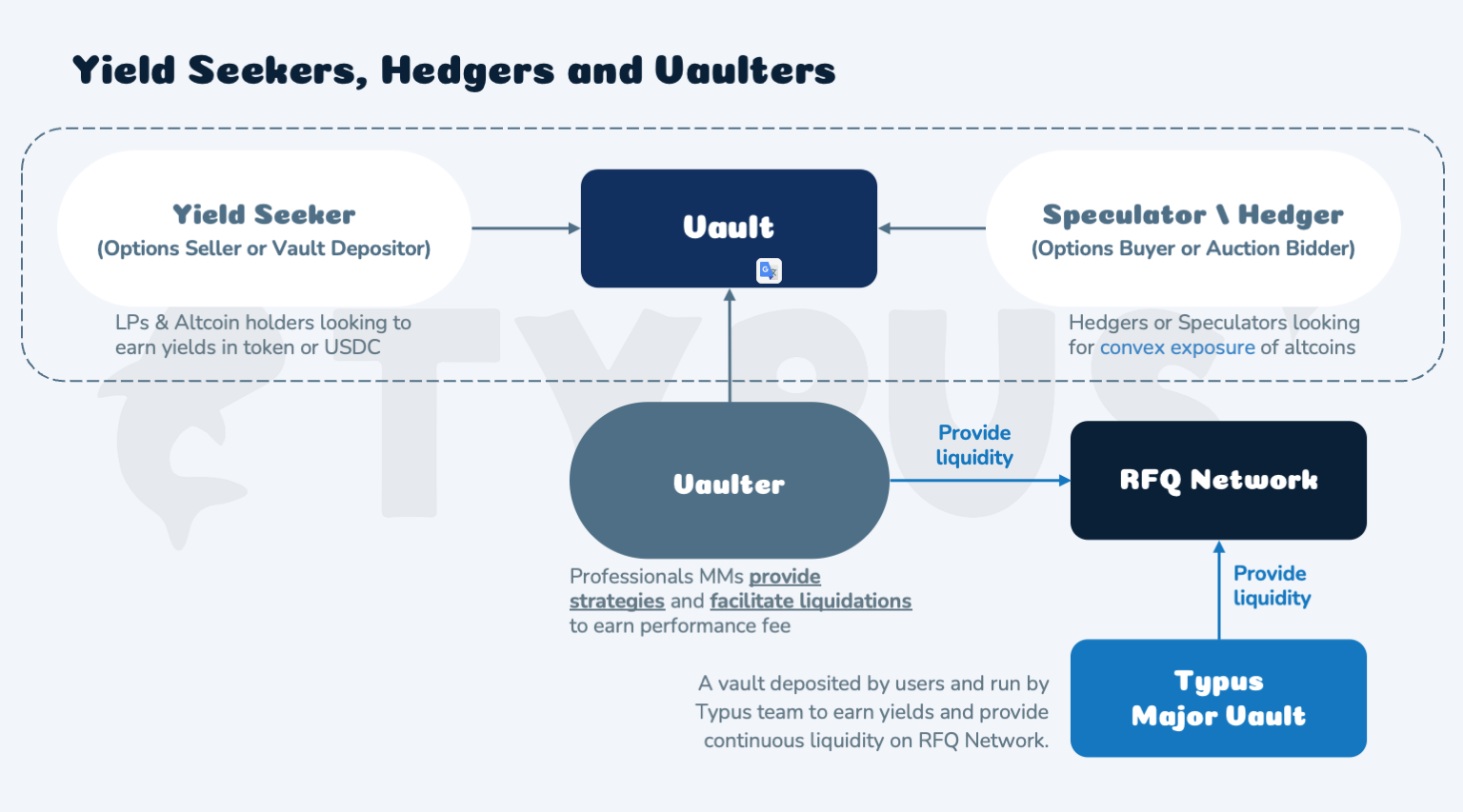

Typus Major Vault:

- The Typus Major Vault (TMV) is an options vault designed for market making, with Typus developing the market-making algorithm. By depositing funds into TMV, users can earn yields as the algorithm automatically provides liquidity in the Request-For-Quote (RFQ) Network by acting as either buyers or sellers.

NFT Options:

Coming soon...

Users:

There'll be three major players on Typus:

Option Seller (Vault Depositor): Yield Seeker

- A call seller is a depositor in the Covered Call vault who uses their underlying assets as collateral to sell a call option and receive a premium. They may receive the premium in underlying tokens or stablecoins. If the buyer chooses to exercise the option at expiration, the seller's underlying assets will be transferred to the buyer.

- A put seller is a depositor of the Put Selling vault. They deposit denomination tokens (e.g., $USDC) as collateral to sell a put option and receive the premium either in underlying tokens (e.g., $SUI) or stablecoins (e.g., $USDC) after an auction ends. If the buyer chooses to execute the contract as the put option expires, the stablecoins deposited by the seller will be transferred to the buyer, which is settled in cash in stablecoins.

Option Buyer (Vault Bidder): Speculator and Hedger

- A call buyer is the Covered Call vault bidder. The buyer needs to bid the option when the vault is auctioned and pay premium either in underlying tokens (such as $SUI) or stablecoins (such as $USDC) after an Auction ends. If the buyer decides to execute the contract as the call option expires, the underlying asset deposited by the seller will be transferred to the buyer, that is, cash-settled in tokens.

- A put buyer is the Put Selling vault bidder. The buyer needs to bid the option when the vault is auctioned and pay premium either in underlying tokens (such as $SUI) or stablecoins (such as $USDC) after an Auction ends. If the buyer decides to execute the contract as the put option expires, the stablecoins deposited by the seller will be transferred to the buyer, that is, cash-settled in stablecoins.

- Vaulter is a platform that provides vault strategies, moderates Modified Dutch Auctions, and facilitates liquidations in the secondary market. However, it is not a permissionless platform and needs approval from Typus to become a vaulter. Typus believes that professional option market makers who can handle liquidation issues are more suited to become vaulters since option strategies can be fully collateralized or leveraged.

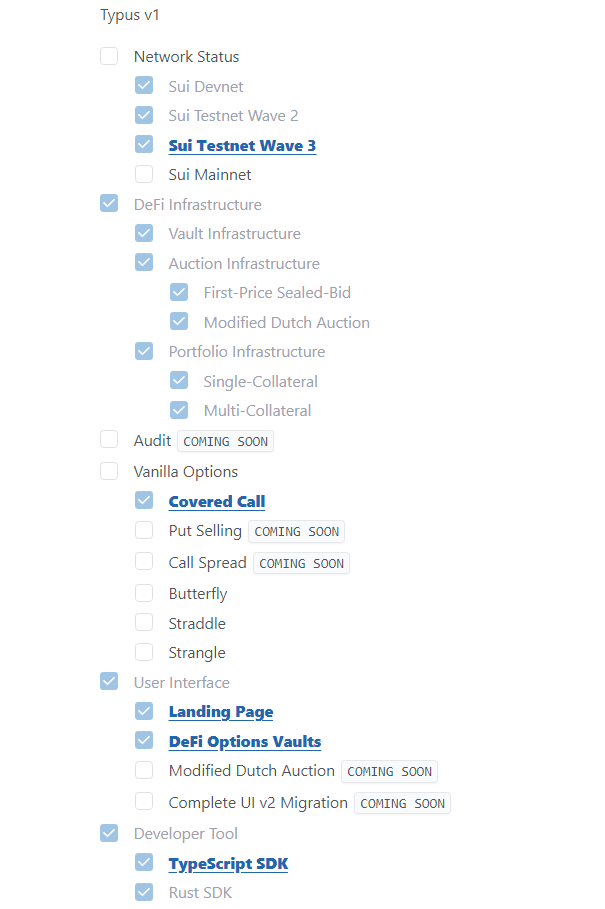

RoadMap:

Future Outlook:

Disclaimer: The following is a personal opinion and should not be taken as financial advice.

- Typus Finance has the potential to become a leading platform in the DeFi space with its innovative approach to liquidity provision and risk management. With the development of tools such as Typus AMM LP Vaults, Typus Auto Rebalancing Tool, and Typus Sharpe Optimizer, Typus is addressing key pain points faced by liquidity providers and options traders in a systematic and programmatic way.

- In the future, it is likely that Typus will continue to expand its range of vault strategies and partner with more liquidity providers and professional option market makers to enhance the liquidity and stability of its platform. As the DeFi space continues to grow, there will be an increasing demand for platforms that offer efficient and reliable liquidity provision, and Typus is well-positioned to meet this demand.

- However, it is important to note that the DeFi space is still in its early stages and is subject to regulatory and market risks. While Typus has taken measures to ensure the safety and security of its platform, there is always a possibility of unforeseen events that may impact the performance of the platform. Therefore, users should conduct their own due diligence and risk assessment before participating in any activities on the Typus platform.

Conclusion:

Typus Finance is an exciting project that aims to solve the challenges facing the DeFi ecosystem. By leveraging the advantages of the Sui Network, the platform offers high-speed trading with low fees, making it an attractive option for traders and liquidity providers. With its ambitious roadmap and strong community support, Typus Finance has the potential to become a leading DeFi platform, offering a wide range of financial products and services.

Links:

Website: https://typus.finance/

Twitter: https://twitter.com/TypusFinance

Medium: https://medium.com/@TypusFinance

Github: https://github.com/Typus-Lab/

Telegram:

Discord: https://discord.com/invite/pzETKp6zvr

Docs: https://docs.typus.finance/

Follow and join the discussion with Web 3 Lab:

Website | Twitter | Tele | Discord | Facebook | Linkedin